Captive Actuarial

Captive Actuarial

Captive Actuarial

Captive Actuarial Services in Kansas City

Risk Management and Tax Planning For Individuals and Corporations

One of the first steps in forming a captive insurance company is preparation of an actuarial feasibility study. These studies document the basis for premium rates and the financial structure of a new captive insurance company. In other words, they describe for the regulator the intended use for the captive. Further, the documentation of a basis for the premium rates assures tax authorities that the premiums are reasonable in relation to the risks assumed.

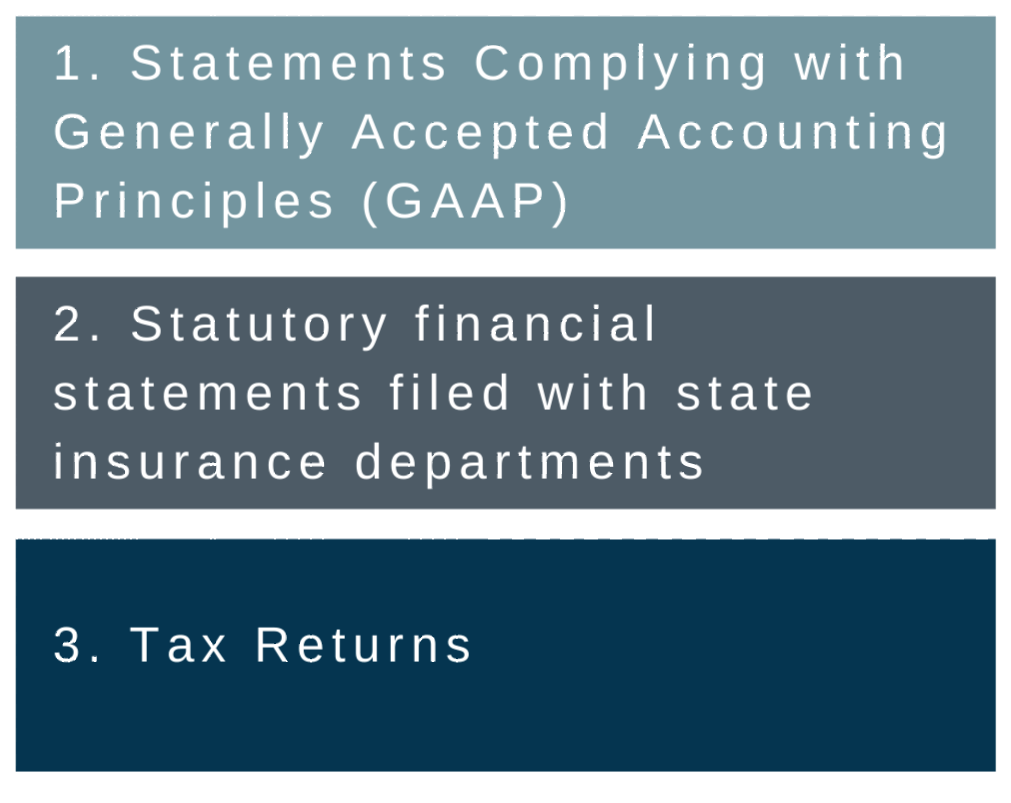

As the captive begins operations it must file annual financial statements with the regulatory authorities. Those statements usually must include an actuarial opinion that the reserves are adequate to meet future obligations.

Finally, the operations of a captive insurance company affect the tax returns and financial statements of its owners. Actuaries are often involved in reserve calculation, financial analysis, and financial projections for captives.

What Economic Risks Do You Face in Your Life?

Stay prepared and plan for future risks.

What can happen to cause you to have a bad year? Wouldn’t it be nice to put aside money in good years and have it available for bad years? Wouldn’t it be even nicer if you could deduct the money you put aside in good years on your income taxes? That’s exactly what you can do with a personal captive insurance company.

I have been involved in the formation of over 150 captive insurance companies over the past 5 years. Some risk examples companies have covered includes but not limited to the following:

- Reputational risk

- Weather risks

- Employee fidelity

- Government administrative actions

- Medical care

- Key person death and disability

As actuary for these insurance companies I set the premium rates and assure that the premiums are reasonable in light of the risks assumed. This work is done through an actuarial feasibility study. I also issue an opinion on the reserves held by the captive at the end of each year. Both reports from an actuary are required by the regulatory authorities where the captive is formed, be it in the US or off shore.

Captive Actuarial Services

in Kansas City

Risk Management and Tax Planning For Individuals and Corporations

One of the first steps in forming a captive insurance company is preparation of an actuarial feasibility study. These studies document the basis for premium rates and the financial structure of a new captive insurance company. In other words, they describe for the regulator the intended use for the captive. Further, the documentation of a basis for the premium rates assures tax authorities that the premiums are reasonable in relation to the risks assumed.

As the captive begins operations it must file annual financial statements with the regulatory authorities. Those statements usually must include an actuarial opinion that the reserves are adequate to meet future obligations.

Finally, the operations of a captive insurance company affect the tax returns and financial statements of its owners. Actuaries are often involved in reserve calculation, financial analysis, and financial projections for captives.

Captive Actuarial Services

in Kansas City

Risk Management and Tax Planning For Individuals and Corporations

One of the first steps in forming a captive insurance company is preparation of an actuarial feasibility study. These studies document the basis for premium rates and the financial structure of a new captive insurance company. In other words, they describe for the regulator the intended use for the captive. Further, the documentation of a basis for the premium rates assures tax authorities that the premiums are reasonable in relation to the risks assumed.

As the captive begins operations it must file annual financial statements with the regulatory authorities. Those statements usually must include an actuarial opinion that the reserves are adequate to meet future obligations.

Finally, the operations of a captive insurance company affect the tax returns and financial statements of its owners. Actuaries are often involved in reserve calculation, financial analysis, and financial projections for captives.

Companies or Individuals Who Own Captive Insurance

Prepare Three Sets of Statements:

.

What Economic Risks Do You Face in Your Life?

Stay prepared and plan for future risks.

What can happen to cause you to have a bad year? Wouldn’t it be nice to put aside money in good years and have it available for bad years? Wouldn’t it be even nicer if you could deduct the money you put aside in good years on your income taxes? That’s exactly what you can do with a personal captive insurance company.

I have been involved in the formation of over 150 captive insurance companies over the past 5 years. Some risk examples companies have covered includes but not limited to the following:

- Reputational risk

- Weather risks

- Employee fidelity

- Government administrative actions

- Medical care

- Key person death and disability

As actuary for these insurance companies I set the premium rates and assure that the premiums are reasonable in light of the risks assumed. This work is done through an actuarial feasibility study. I also issue an opinion on the reserves held by the captive at the end of each year. Both reports from an actuary are required by the regulatory authorities where the captive is formed, be it in the US or off shore.

What Economic Risks Do You Face in Your Life?

Stay prepared and plan for future risks.

What can happen to cause you to have a bad year? Wouldn’t it be nice to put aside money in good years and have it available for bad years? Wouldn’t it be even nicer if you could deduct the money you put aside in good years on your income taxes? That’s exactly what you can do with a personal captive insurance company.

I have been involved in the formation of over 150 captive insurance companies over the past 5 years. Some risk examples companies have covered includes but not limited to the following:

- Reputational risk

- Weather risks

- Employee fidelity

- Government administrative actions

- Medical care

- Key person death and disability

As actuary for these insurance companies I set the premium rates and assure that the premiums are reasonable in light of the risks assumed. This work is done through an actuarial feasibility study. I also issue an opinion on the reserves held by the captive at the end of each year. Both reports from an actuary are required by the regulatory authorities where the captive is formed, be it in the US or off shore.

Blog

Let's Talk Business

Blog

Let's Talk Business

Contact Jeff

Do you have a problem that needs addressed right away?

I might have the experience and

expertise to address it. Please

send me a message, let’s get to

know one another, then we’ll

strategize how we can help

you succeed.

Get started by using the

form on the right or

contacting me directly at

913-707-0067.

Contact Us

We will get back to you as soon as possible

Please try again later

Contact Jeff

Do you have a problem that needs addressed right away?

I might have the experience and

expertise to address it. Please

send me a message, let’s get to

know one another, then we’ll

strategize how we can help

you succeed.

Get started by using the

form on the right or

contacting me directly at

913-707-0067.

Contact Us

We will get back to you as soon as possible

Please try again later

Contact Jeff

Do you have a problem that needs addressed right away?

I might have the experience and expertise to address it. Please send me a message, let’s get to know one another, then we’ll strategize how we can help you succeed.

Get started by using the

form on the right or

contacting me directly at

913-707-0067.

Contact Us

We will get back to you as soon as possible

Please try again later

Proudly Serving Kansas City

For Over 40 Years

Menu

Sectors

Marketing Actuarial

Valuation Actuarial

Financial Actuarial

Captive Actuarial

Contact

Proudly Serving Kansas City For Over 40 Years

Quick Links

Contact

Proudly Serving Kansas City For Over 40 Years